new york salt tax workaround

The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. New York State Budget Changes.

Salt Deduction Work Arounds Receive Irs Blessing Look For More States To Enact Them Marks Paneth

PdfDownload pdf14 MB Legislation enacted by New York State will allow a New York City City partnership or resident S corporation to elect to be subject to a new 3876 entity level tax.

. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed. Tax Increases SALT Cap Workaround and Additional COVID Relief By James Jay M.

SALT cap workaround enacted for 2023. Through New Yorks other SALT workaround known as the states Employers Compensation Expense Tax ECET employers that opt in will pay a payroll tax on employees. The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap.

It allows individuals with income from pass-through entities such as LPs LLCs and S Corps to mitigate the. Connecticuts pass-through entity PTE tax for the SALT cap workaround is mandatory which is unique. 25 2021 1107 AM.

8 2022 145 AM. New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround. Avoiding the SALT Limitation New York Enacts a Pass-Through Entity Tax to Help Taxpayers Work Around the SALT Limitation.

The provision was part of Gov. April 7 2021 Louis Vlahos Tax. New York Budget Deal Includes SALT Cap Workaround.

New York Budget Deal Includes SALT Cap Workaround. Proposed New York State Unincorporated Business Tax Provides SALT Limitation Workaround. July 1 2021 By WFFA.

When coupled with New York Citys tax rate of 3876. Pass-Through Entity Tax Update Part I. New York States April 2021 budget now law created a workaround to the SALT limitation in the form of a pass-through entity tax PTET which is an optional tax that.

Friday December 18 2020. And some lawmakers have. 16 2020 New York legislation was submitted.

New York State issues guidance on SALT cap workaround - Mazars - United States. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through. By Louis Vlahos on April 7 2021.

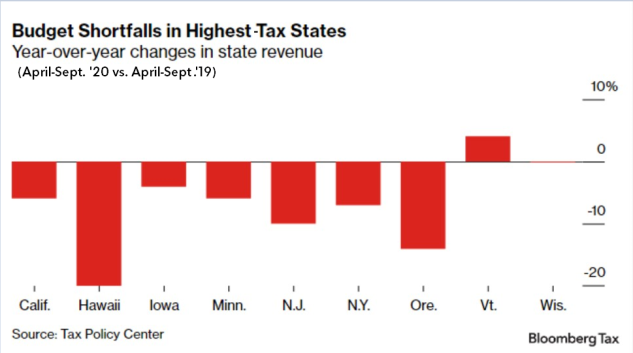

On April 6 2021 New York Gov. Enacted by the Tax Cuts and Jobs Act in 2017 the SALT cap has been a pain point for filers in high-tax states such as New York and New Jersey. The New York State legislature and NYS Governor Cuomo reached an agreement for the fiscal year.

New York State Lawmakers Finally Agree to SALT Workaround. New York City. New York State 20212022 Budget Act SALT Cap Workaround The New York State NYS 20212022 Budget Act was signed into law on April 19 2021.

Posted in New York State. Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through. Cuomos initial budget proposal in January and it comes at a time when many.

The Pass-Through Entity tax allows an eligible entity. New York Releases SALT Cap Workaround Guidance. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a.

The New York Department of Taxation has released guidance for business owners looking to circumvent the 10000 cap on state and local tax deductions. The trend among states to adopt elective pass-through entity taxes or PTETs emerged as. The limitation on the.

The New York state budget deal announced yesterday. New Yorks pass-through entity tax PTET is one such SALT workaround. The legislation is intended to provide a workaround for the 10000 limitation on deductions of state and local taxes SALT put in place in the Tax Cuts and Jobs Act of 2017.

New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021. The PTE election deadline for New York State is October 15 2021.

SALT Cap Workaround. Late last year the IRS issued a notice which allowed the deductibility of the entity-level tax in calculating flow-through income of the entity owner blessing this version of the.

Avoiding The Salt Limitation New York Enacts A Pass Through Entity Tax To Help Taxpayers Work Around The Salt Limitation Wffa Cpas

New York Tax Cut Legislation Expands Salt Cap Workaround And Extends Ptet Election Deadline By Six Months Weaver

S Corp Workaround For Salt Deduction Cap Wcre

New York City Salt Cap Workaround Enacted For 2023 Kpmg United States

New York S Salt Workaround New Guidance Affected Industries And What To Know Before The October 15 2021 Deadline Insights Venable Llp

Goldstein Often Overlooked Tax Savings Opportunity The Salt Cap Workaround Long Island Business News

Governor Signs Bill That Could Provide Pass Through Entities A Salt Deduction Cap Workaround

Ny California Others Set To Work Around Salt Deduction Cap

New York State Lawmakers Finally Agree To Salt Workaround Barclay Damon

Pass Through Entity Salt Cap Workaround Lancaster Cpa Firm

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

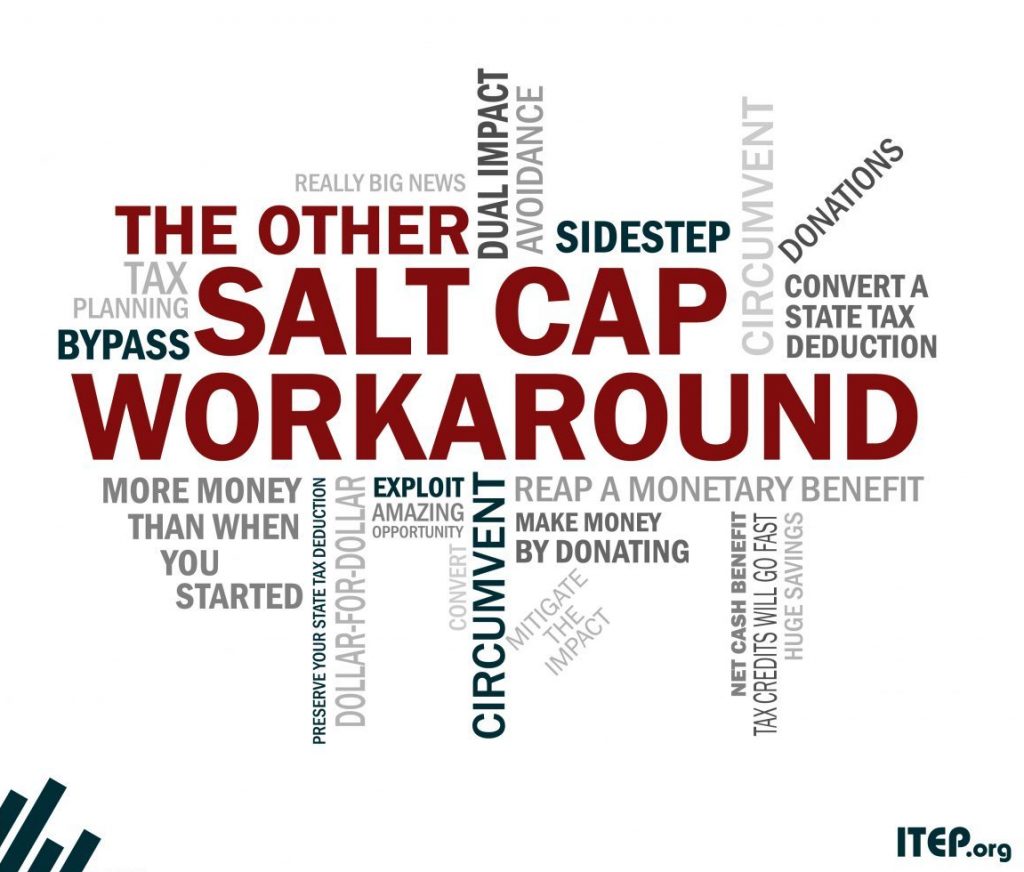

The Other Salt Cap Workaround Accountants Steer Clients Toward Private K 12 Voucher Tax Credits Itep

Ny State Pass Through Entity Tax A S A L T Cap Workaround Fuoco Group

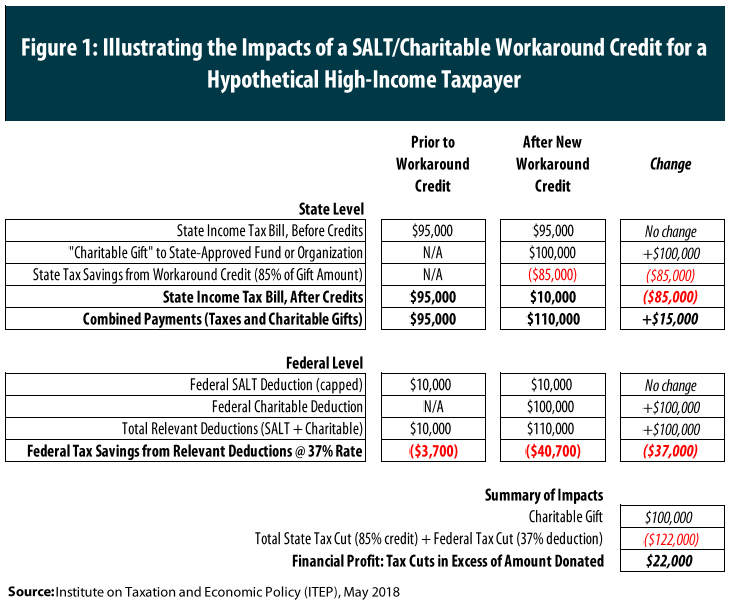

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

The Pass Through Entity Workaround To Beat The Salt Limitation Certified Tax Coach

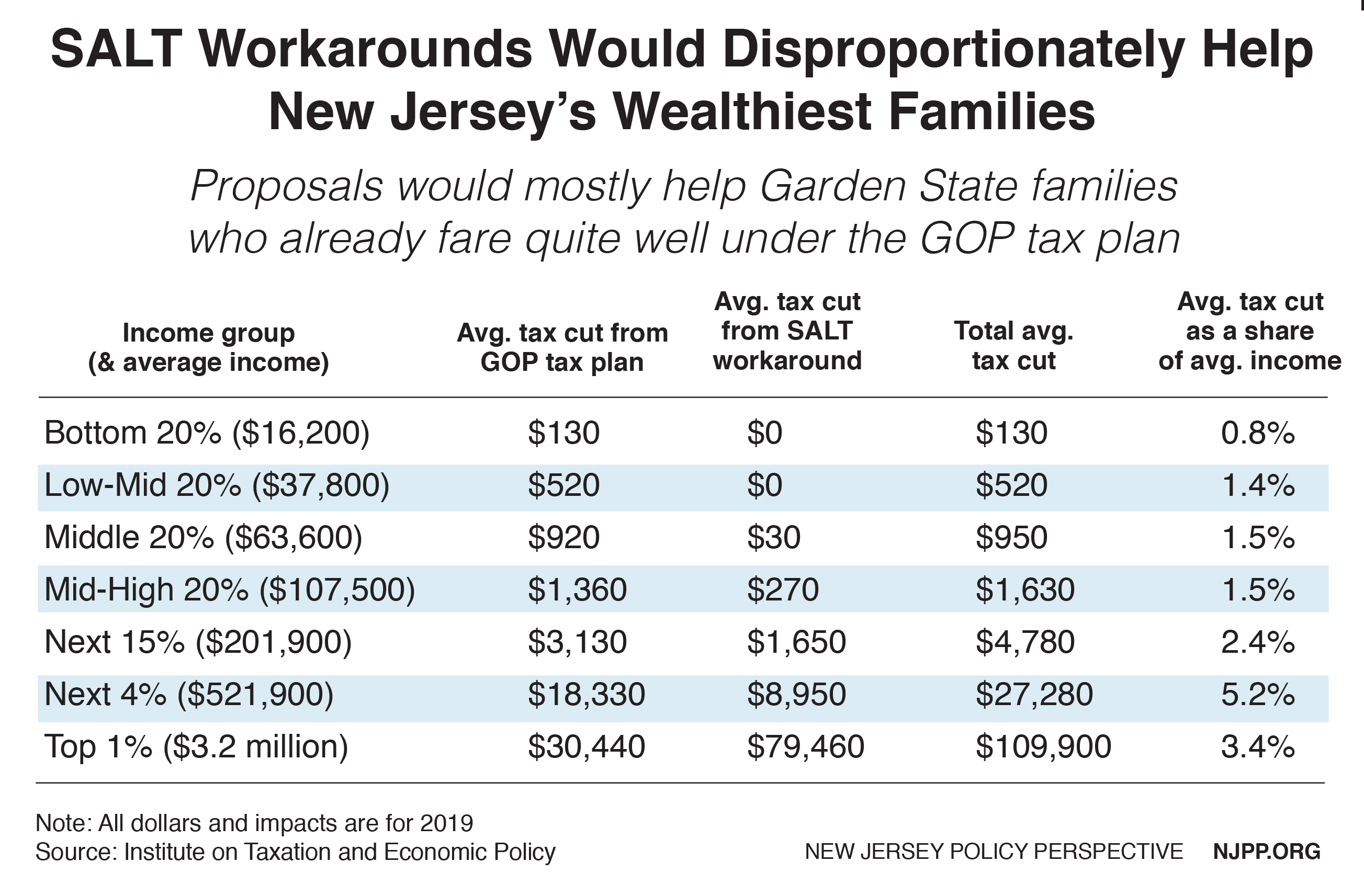

A Grain Of Salt New Jersey Needs More Than Workarounds To Respond To Gop Tax Plan New Jersey Policy Perspective

California Salt Cap Workaround Offered For Pass Through Entity Owners

New York State Elective Pass Through Entity Tax Salt Cap Workaround Dannible And Mckee Llp

_Table-1800px_v2a.jpg)

Can You Benefit From The Salt Cap Workaround J P Morgan Private Bank