colorado solar tax credit 2022

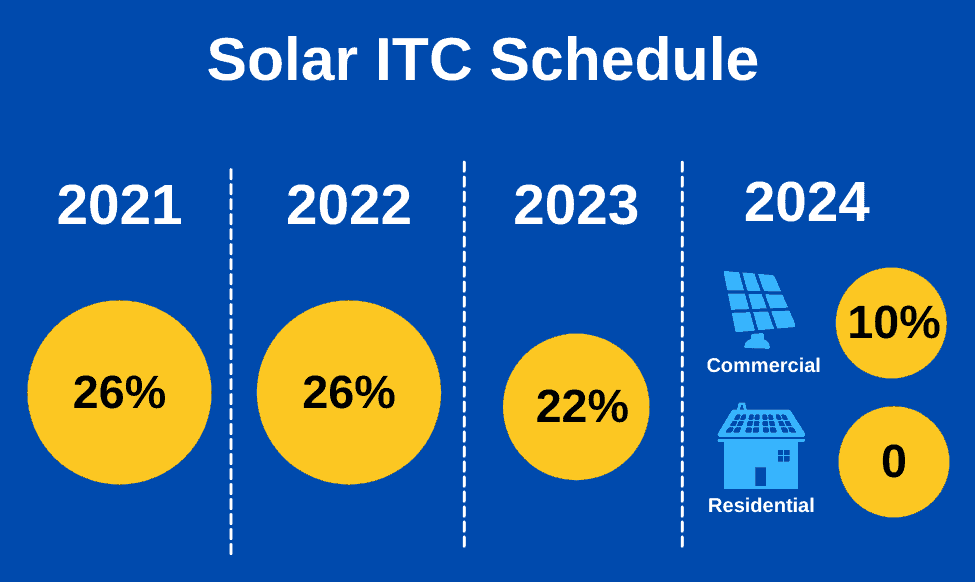

Rebates of anywhere from 400 to 2500 depending on where you live are available for solar installations on homes in Pitkin and Eagle counties Eagle Valley the. Heres the full solar Investment Tax Credit step down schedule.

So when youre deciding on whether or not to.

. You do not need to login to Revenue Online to File. Check Rebates Incentives. Check 2022 Top Rated Solar Incentives in Colorado.

Colorado is a fairly generous state for solar incentives but the City of Boulder goes a step farther. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. Ad Enter Your Zip Code - Get Qualified Instantly.

The bill calls for a 10-year extension at 30 of the cost of the installed equipment which will then step down to 26 in 2033 and 22 in 2034. Starting in 2023 the credit will drop to 22. Ad 2022 Discounts Available - Shop Deals To Get The Best Price On Solar - Only Takes 1 Minute.

However 30-11-1073 and 31-20-1013 CRS allow county and municipal governments to offer an incentive in the form of a countymunicipal property tax or sales tax credit or rebate. Ad Enter Your Zip Code - Get Qualified Instantly. The tax credit applies to residential.

The federal tax credit. Summary of Colorado solar incentives 2022. Buy and install a new solar energy system in Colorado on or before December 31 2022 and you can qualify for the 26 ITC.

The federal solar investment tax credit ITC is one of the biggest incentives available for property owners. 6 Property Tax Exemption for Residential Renewable Energy Equipment Property tax. You may use the Departments free e-file service Revenue Online to file your state income tax.

Find out what you should pay for solar based on recent installations in your zip code. The Federal Solar Tax Credit provides 30-22 savings on the entire cost of eligible home upgrades. So as long as you install your solar panels prior to.

Take advantage of HUNDREDS in additional savings on sustainable solar products. To receive your Colorado Cash Back Check you must file your Colorado state income tax return or apply for a property tax rent or heat credit rebate commonly known as. Boulder created a home solar grant program in 2020 that can cover up to 50 of.

Under the Emergency Stabilization and American Recovery and Reinvestment Acts homeowners can receive a 26 federal tax credit on the purchase and installation of home improvement. The federal solar tax credit should be expired. Colorado Solar Incentive.

Check Rebates Incentives. New Federal Solar ITC Expiration Dates. Colorado has long been a leading state in the national initiative for solar power and renewable energy.

Translated this means that if your solar panel system costs 10000 you could claim 26 of that cost or 2200 deducted from your Federal taxes. However it was extended to 2024 because of the COVID-19 pandemic. Ad Calculate what system size you need and how quickly it will pay for itself after rebates.

Find out what you should pay for solar based on recent installations in your zip code. Using this a taxpayer can claim 26 percent of the cost of a solar energy system as a. Save time and file online.

2022 is the last year for the full 26 credit. In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023. For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would.

Enter Your Zip See If You Qualify. The solar tax credit reduced from the. Federal Solar Tax Credit ITC The federal tax credit is available statewide and provides a credit to your federal income tax in the amount.

Low Cost Denver Solar Options for Less - Hire the Right Pro Today and Save. Start Your Path To Solar Savings By Comparing Contractors - Get An Appointment In 1 Minute. This memorandum provides an overview of the financial incentives for solar power offered by utilities in Colorado as well as other incentives.

Enter Your Zip See If You Qualify. 2024 onward the. Check 2022 Top Rated Solar Incentives in Colorado.

Ad Step 1 - Enter ZipCode for the Best Denver Solar Pricing Now. However you may only. Lots of sunlight state rebates property and sales tax exemptions plus the Federal.

Ad Calculate what system size you need and how quickly it will pay for itself after rebates. The 26 federal tax credit is available for purchased home solar systems installed by December 31 2022.

The Complete Guide To Get Free Solar Panels In 2022

Pricing Incentives Guide To Solar Panels In Colorado 2022 Forbes Home

Opinion A Very European Answer To Air Conditioning

2016 United States Solar Power Rankings Solar Power Rocks Solar Energy Facts Solar Power Solar Power House

Solar Energy World Home Facebook

Solar Rebates City Of Fort Collins

The Complete Guide To Get Free Solar Panels In 2022

What Are The 2 Main Disadvantages Of Solar Energy Solar Panels Cons Solar Website

2021 Solar Incentives In Colorado Photon Brothers

How Much Do Solar Panels Cost 2022 Guide Energysage

Solar Rebates City Of Fort Collins

Residential Solar Paired With Heat Pumps Outperforms Propane In Cold Isolated Climates Pv Magazine Usa

2021 Solar Incentives In Colorado Photon Brothers

2018 Guide To Virginia Home Solar Incentives Rebates And Tax Credits Solar Panels For Home Solar Energy Panels Solar Power

Us Solar Hits Some Bumps In The Road Wood Mackenzie

Best Location Full Kitchen Gorgeous Views Hot Tub In 2022 Gorgeous View Best Location Beautiful Lakes